Eversource Energy Stock: Is ES Underperforming the Utilities Sector?

Valued at $23.5 billion by market cap, Eversource Energy (ES) is a publicly traded utility holding company based in New England, providing regulated electric, natural gas, and water delivery services. It operates in three U.S. states, Connecticut, Massachusetts, and New Hampshire, serving about 4.4 million customers across those states.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and ES perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the regulated electric utility industry. Eversource Energy’s key strengths lie in its strong regulated utility model, serving 4.4 million customers across New England with electricity, natural gas, and water distribution. The company has also sharpened its focus by divesting non-core businesses, like offshore wind and water utilities, strengthening its balance sheet and positioning itself for more stable, long-term growth.

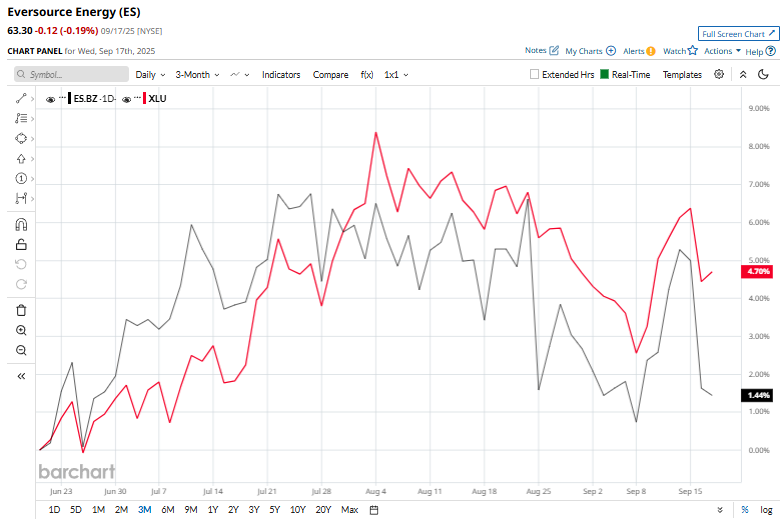

ES slipped 7.1% from its 52-week high of $68.17. Shares of ES gained marginally over the past three months, trailing the Utilities Select Sector SPDR Fund's (XLU) 5% return over the same time frame.

In the longer term, shares of ES rose 10.2% on a YTD basis, underperforming XLU’s 11.4% rise. Moreover, the stock has dropped 7.2% over the past 52 weeks, trailing XLU’s 6.7% returns over the same time frame.

ES has been trading above its 200-day moving average since mid-May, but has dipped below its 50-day moving average since the end of August.

On Aug. 25, Eversource shares fell over 4% following the Trump administration’s decision to block construction of Ørsted’s nearly completed Revolution offshore wind project, exposing the company to liabilities tied to its sale to Global Infrastructure Partners.

ES’ rival, PPL Corporation (PPL) shares have taken the lead over the stock, with a 9.9% gain over the past 52 weeks, but lagged behind the stock with a 9.7% return on a YTD basis.

The stock has a consensus “Moderate Buy” rating from the 17 analysts covering it, and the mean price target of $70.77 suggests a potential upside of 11.8% from current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.